QuickLinks-- Click here to rapidly navigate through this documentProxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

Internap Network Services Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

ý | | Preliminary Proxy Statement |

o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | | Definitive Proxy Statement |

o | | Definitive Additional Materials |

o | | Soliciting Material Pursuant to §240.14a-12

|

Internap Network Services Corporation |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | |

Payment of Filing Fee (Check the appropriate box): |

ýx | | No fee required |

o¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | (1) | | Title of each class of securities to which transaction applies:

|

| | (2) | | Aggregate number of securities to which transaction applies:

|

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) | | Proposed maximum aggregate value of transaction:

|

o¨ | | Fee paid previously with preliminary materials. |

o¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid:

|

| | (2) | | Form, Schedule or Registration Statement No.:

|

Internap Network Services Corporation

Two Union Square

601 Union Street, Suite 1000

Seattle, Washington 98101

March ,

November 8, 2002

Dear Internap Stockholder:

It is my pleasure to invite you to Internap Network Services

Corporation's 2002 AnnualCorporation’s Special Meeting of Stockholders (the

"Annual Meeting"“Special Meeting”)

. This year's meeting will be held at

the Sheraton Hotel & Towers, 1400 6th Avenue, Seattle, Washington,Internap’s offices at 250 Williams Street NW, Suite E-100, Atlanta, Georgia, on

Tuesday, May 14,December 17, 2002, at 9:00 a.m. local time.

Details of the business to be conducted at the

AnnualSpecial Meeting are given in the attached Notice of

AnnualSpecial Meeting and proxy statement.

Whether or not you plan to attend the AnnualSpecial Meeting, we hope you will have your shares of common stock and/or Series A preferred stock represented by marking, signing, dating and returning your proxy card in the enclosed envelope as soon as possible. Your stock will be voted in accordance with the instructions you have given in your proxy card. You may, of course, attend the AnnualSpecial Meeting and vote in person even if you have previously returned your proxy card.

Very truly yours,

Gregory Peters

President and Chief Executive Officer

| | Very truly yours, |

|

|

|

| | Eugene Eidenberg

Chairman and Chief Executive Officer |

INTERNAP NETWORK SERVICES CORPORATION

Two Union Square

601 Union Street, Suite 1000

Seattle, Washington 98101

NOTICE OF ANNUALSPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 14,DECEMBER 17, 2002

TO TOTHE STOCKHOLDERS STOCKHOLDERSOF INTERNAP NETWORK SERVICES CORPORATION: INTERNAP NETWORK SERVICES CORPORATION:NOTICE IS HEREBY GIVENNOTICE IS HEREBY GIVEN that the AnnualSpecial Meeting of Stockholders ofINTERNAP NETWORK SERVICES CORPORATION INTERNAP NETWORK SERVICES CORPORATION, a Delaware corporation (the “Company”), will be held on May 14,December 17, 2002, at 9:00 a.m. local time at the Sheraton Hotel & Towers, 1400 6th Avenue, Seattle, WashingtonInternap’s offices at 250 Williams Street NW, Suite E-100, Atlanta, Georgia, for the following purposes:1.To consider and approve an amendment to our certificate of incorporation and bylaws to allow holders of our Series A preferred stock to take action by written consent.

2.To elect three directors to hold office until the 2005 Annual Meeting of Stockholders.

3.To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

| 1. | | To consider and vote upon one proposal to approve six separate amendments to our certificate of incorporation to authorize the board of directors in its sole discretion to effect a reverse stock split, ranging from a one-for-five reverse stock split to a one-for-thirty reverse stock split, of all the issued and outstanding shares of our common stock, par value $0.001 per share, in order to maintain our listing on The Nasdaq SmallCap Market and seek to transfer our listing back to The Nasdaq National Market. The board of directors may abandon any of the amendments or make one of the amendments effective by filing such amendment with the Secretary of State of the State of Delaware at such time or times as the board of directors determines to be necessary in order to maintain our listing on The Nasdaq SmallCap Market and seek to transfer our listing back to The Nasdaq National Market, on or prior to the nine month anniversary of the Special Meeting; and |

| 2. | | To transact such other business as may properly come before the Special Meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the proxy statement accompanying this Notice.

The board of directors has fixed the close of business on March 25,October 31, 2002 as the record date for the determination of stockholders entitled to notice of and to vote at this AnnualSpecial Meeting and at any adjournment or postponement thereof.

BY ORDEROFTHE BOARDOF DIRECTORS

Gregory Peters

President and Chief Executive Officer

Seattle, Washington

November 8, 2002

ALLSTOCKHOLDERSARECORDIALLYINVITEDTOATTENDTHEMEETINGINPERSON. WHETHERORNOTYOUEXPECTTOATTENDTHEMEETING,PLEASECOMPLETE,DATE,SIGNANDRETURNTHEENCLOSEDPROXYASPROMPTLYASPOSSIBLEINORDERTOENSUREYOURREPRESENTATIONATTHEMEETING. ARETURNENVELOPE (WHICHISPOSTAGEPREPAIDIFMAILEDINTHE UNITED STATES)ISENCLOSEDFORTHATPURPOSE. EVENIFYOUHAVEGIVENYOURPROXY,YOUMAYSTILLVOTEINPERSONIFYOUATTENDTHEMEETING. PLEASENOTE,HOWEVER,THATIFYOURSHARESOFCOMMONSTOCKOR SERIES APREFERREDSTOCKAREHELDOFRECORDBYABROKER,BANKOROTHERNOMINEEANDYOUWISHTOVOTEATTHEMEETING,YOUMUSTOBTAINFROMTHERECORDHOLDERAPROXYISSUEDINYOURNAME.

| | | BY ORDER OF THE BOARD OF DIRECTORSPage

|

|

|

|

| | John M. Scanlon

Chief Financial Officer,

Vice President of FinanceInformation Concerning Solicitation and Administration,

Treasurer and SecretaryVoting |

Seattle, Washington

March , 2002 |

|

|

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. A RETURN ENVELOPE (WHICH IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES) IS ENCLOSED FOR THAT PURPOSE. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

TABLE OF CONTENTS

| | Page

|

|---|

Summary | | |

|

| | 1 |

|

| | 1 |

|

Proposal 1: Approval of Amendments to Certificate of Incorporation to Effect a Reverse Stock Split | | |

Information Concerning Solicitation and Voting | | 1 |

| | | 1 |

| Solicitation | | 1 |

| Voting rights, outstanding shares and vote required | | 1 |

| Granting a proxy on the Internet | | 2 |

| Revocability of proxies | | 2 |

| Stockholder proposals | | 3 |

Proposal 1 | | |

Amend Our Certificate of Incorporation and Bylaws | | 3 |

| Introduction | | 3 |

| Summary description of amendments | | 3 |

Proposal 2 | | |

Election of Directors | | 4 |

| Nominees for election for a three-year term expiring at the 2005 annual meeting | | 4 |

| Director continuing in office until the 2003 annual meeting | | 5 |

| Directors continuing in office until the 2004 annual meeting | | 5 |

| Board of directors committees and meetings | | 6 |

|

| | 7 |

|

| | 10 |

|

| | 12 |

|

| | 12 |

|

| | 12 |

|

| | 13 |

|

| | 14 |

|

| | 14 |

|

| | 14 |

|

| | 15 |

|

| | 15 |

|

| | 7 |

Executive Officers | | 10 |

Executive Compensation | | 12 |

| Compensation of directors | | 12 |

| Compensation of executive officers | | 12 |

| Employment agreements and change in control | | 16 |

Report of the Compensation Committee of the Board of Directors on Executive Compensation | | 17 |

| Executive officer compensation | | 17 |

| Compensation of Internap's Chief Executive Officer | | 18 |

| Compensation committee members | | 19 |

| Compensation committee interlocks and insider participation | | 19 |

| Change of control arrangements in equity incentive plans | | 19 |

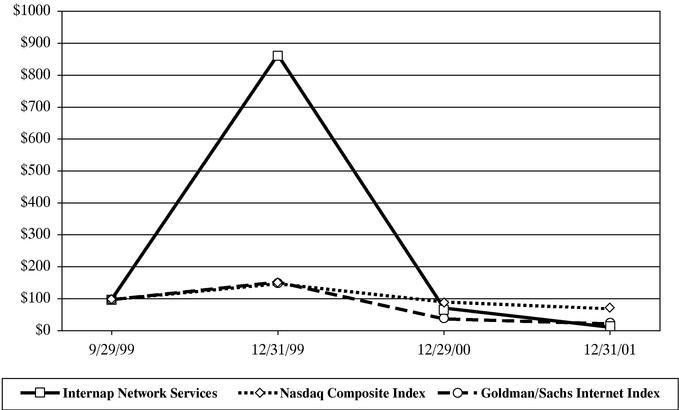

| Performance measurement comparison | | 20 |

Report of the Audit Committee of the Board of Directors | | 21 |

| Audit committee members | | 21 |

| Independent accountants | | 21 |

Certain Relationships and Transactions | | 22 |

Section 16(a) Beneficial Ownership Reporting Compliance | | 22 |

Other Business | | 23 |

Appendix A—Proposed Amendments to Certificate of Incorporation and Bylaws | | A-1 |

INTERNAP NETWORK SERVICES CORPORATION

Two Union Square

601 Union Street, Suite 1000

Seattle, Washington 98101

PROXY STATEMENT

FOR ANNUALSPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 14,DECEMBER 17, 2002

INFORMATION CONCERNING SOLICITATIONAND VOTING

GeneralINFORMATION CONCERNING SOLICITATION AND VOTINGGeneral

We are soliciting proxies on behalf of our board of directors for use at our annual meetingSpecial Meeting of stockholders on May 14,December 17, 2002 at 9:00 a.m. local time or at any adjournment or postponement of the annual meeting.Special Meeting. The annual meetingSpecial Meeting will be held at the Sheraton Hotel & Towers, 1400 6th Avenue, Seattle, Washington.Internap’s offices at 250 Williams Street NW, Suite E-100, Atlanta, Georgia. We intend to mail this proxy statement and accompanying proxy card on or about March 27,November 13, 2002 to all stockholders entitled to vote at the annual meeting.Special Meeting.

Solicitation We will bear the entire cost of solicitation of proxies, including the costs of preparing, assembling, printing and mailingWhy am I receiving this proxy statement and proxy card?

You are receiving a proxy statement and proxy card because you own shares of common stock and/or Series A preferred stock of Internap Network Services Corporation. This proxy statement describes an issue on which we would like you, as a stockholder, to vote. It also gives you information on this issue so that you can make an informed decision.

When you sign the proxy card, you appoint Gregory Peters and John Scanlon as your representatives at the Special Meeting. Mr. Peters and Mr. Scanlon will vote your shares, as you have instructed them on the proxy card, at the Special Meeting. This way, your shares will be voted whether or not you attend the Special Meeting.

Even if you plan to attend the Special Meeting, it is a good idea to complete, sign and return your proxy card in advance of the Special Meeting in case your plans change.

We do not know of any additional information furnishedother issues that will be considered. However, if an issue comes up for vote at the Special Meeting that is not on the proxy card, Mr. Peters and Mr. Scanlon will vote your shares under your proxy in accordance with their judgment.

What am I voting on?

You are being asked to stockholders. We will furnish copiesvote on the adoption and approval of solicitation materialssix separate amendments to banks, brokerage houses, fiduciaries and custodians holding in their names sharesour certificate of incorporation to effect a reverse stock split, ranging from a one-for-five reverse stock split to a one-for-thirty reverse stock split, of our common stock beneficially owned by othersstock. Each of these changes is further described below in “Proposal 1: Approval of Amendments to forwardCertificate of Incorporation to such beneficial owners. We may reimburse persons representing beneficial ownersEffect a Reverse Stock Split” of common stock for their costs of forwarding solicitation materialsthis proxy statement.

Who is entitled to such beneficial owners. We have engaged W.F. Doring & Co., Inc., a professional proxy solicitation firm, to solicit proxies on our behalf and anticipate the cost of those services will be $8,000. We may supplement the original solicitation of proxies by mail, by telephone, telegram or personal solicitation by our directors, officers or other regular employees. We will not pay any additional compensation to directors, officers or other regular employees for such services.Voting rights, outstanding shares and vote requiredvote?

Only holders

Stockholders of record of our common stock and our Series A preferred stock atas of the close of business on March 25,October 31, 2002 will beare entitled to notice of, andvote. This date is referred to vote at,as the annual meeting. At the close of business on March 25, 2002, we had outstanding and entitled to vote shares of common stock (including 68,454,513 shares of common stock issuable upon conversion of 3,171,499 outstanding shares of our Series A preferred stock).“record date.” Each holder of record of our

common stock on

March 25, 2002the record date will be entitled to one vote for each share

of common stock held on all matters to be voted upon at the

annual meeting.Special Meeting. Each holder of record of our Series A preferred stock on

March 25, 2002the record date will be entitled to

approximately 21.6 votes per share of Series A preferred stock (rounded to the

numbernearest whole share after aggregation of

votes equal toall shares held by each holder of Series A preferred stock), which represents the number of shares of common stock into which

such shareseach share of Series A preferred stock

could then be convertedis currently convertible pursuant to

Section IV(D)(4) of our certificate of incorporation.

Proposal 1

How many shares can be voted?

According to the records of our transfer agent, at the close of business on the record date, we had outstanding and entitled to vote 219,721,294 shares of common stock (including 60,567,732 shares of common stock issuable upon conversion of 2,806,103 outstanding shares of our Series A preferred stock).

How many votes do you need to hold the meeting?

A majority of our outstanding shares of capital stock entitled to vote as of the record date, equal to 109,860,648 shares, must be present at the Special Meeting either in person or by proxy in order to hold the Special Meeting and conduct business. This is called a quorum.

Abstentions and broker non-votes (meaning proxies submitted by brokers as holders of record on behalf of their customers that do not indicate how to vote on the proposal) are also considered part of the quorum.

How many votes are required to approve the proposal?

The proposal to amend our certificate of incorporation to effect a reverse stock split will be

deemed approved

and ratifiedby the stockholders if

it receives (1) the affirmative vote of a majority of the

all votes entitled to be cast on the

matter and (2) the affirmative vote of the majority of the votes1

attributable to outstandingamendment, including shares of our Series A preferred stock. Holderscommon stock issuable upon conversion of our Series A preferred stock, have already approved Proposal 1 at a special meeting of Series A Preferred stockholders held on February 21, 2002. Accordingly, only holders of our common stock will vote on Proposal 1 at“FOR” the annual meeting. proposal.

Abstentions and broker non-votes because they(as defined above) are not affirmativecounted in the tally of votes FOR or AGAINST the proposal and will have the same practicaleffect as votes AGAINST the proposal. A WITHHELD vote has the same effect as an abstention.

What if I return my proxy card but do not provide voting instructions?

If you sign and return your proxy card, but do not include instructions, your proxy will be voted “FOR” the proposal to amend our certificate of incorporation to effect a reverse stock split.

What does it mean if I receive more than one proxy card?

It means that you have multiple accounts at the transfer agent and/or with brokers. Please sign and return all proxy cards to ensure that all your shares are voted. You may wish to consolidate as many of your transfer agent or brokerage accounts as possible under the same name and address for better customer service.

What is householding?

The Securities and Exchange Commission (the “SEC”) has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements with respect to two or more security holders sharing the same address by delivering a single proxy statement addressed to those security holders. This process, which is commonly referred to as “householding,” potentially means extra convenience for securityholders and cost savings for companies.

A number of brokers with account holders who are Internap stockholders will be “householding” our proxy materials. A single proxy statement will be delivered to multiple stockholders sharing an address unless contrary

instructions have been received from the affected stockholders. Once you have received notice from your broker or us that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If at any time you no longer wish to participate in “householding” and would prefer to receive a separate proxy statement, please notify your broker, direct your written request to Internap Network Services Corporation, Attention: Investor Relations, Two Union Square, 601 Union Street, Suite 1000, Seattle, Washington 98101, or contact Investor Relations at (206) 441-8800. Stockholders who currently receive multiple copies of the proxy statement at their address and who would like to request “householding” of their communications should contact their broker.

What if I change my mind after I return my proxy?

You may revoke your proxy and change your vote at any time before the polls close at the Special Meeting. You may do this by:

| • | | sending written notice to our Secretary at our principal executive office (Two Union Square, 601 Union Street, Suite 1000, Seattle, Washington 98101); |

| • | | signing another proxy with a later date; or |

| • | | voting again at the meeting. |

However, please note that attendance at the Special Meeting will not, by itself, revoke your proxy.

Will my shares be voted if I do not sign and return my proxy card?

If your shares are held in street name, your brokerage firm may vote your shares under certain circumstances. These circumstances include certain “routine” matters, such as the election of directors. Therefore, if you do not vote your proxy, your brokerage firm may either vote your shares on routine matters, or leave your shares unvoted. When a brokerage firm votes its customers’ unvoted shares on routine matters, these shares are counted for purposes of establishing a quorum to conduct business at the meeting.

A brokerage firm cannot vote customers’ shares on non-routine matters. The proposal to amend our certificate of incorporation to effect a reverse stock split is a non-routine matter. Therefore, if your shares are held in street name and you do not return your proxy, your shares will NOT be voted on the proposed amendments and, accordingly, will have the same effect as a vote against Proposal 1. In connection with Proposal 2,“AGAINST” the nominees for election asamendments. If your broker submits your proxy without your vote (i.e., a broker non-vote), your shares will, however, be counted in determining whether there is a quorum.

Who will count the votes?

Our board of directors who receive the greatest number of votes cast that are present in person or represented by proxy at the annual meeting willhas selected Investor Voting Services (“IVS”) to be elected as directors. Abstentions and broker non-votes will have no effect on the outcome of Proposal 2. All votes will be tabulated by the inspector of election appointed forelections at the Special Meeting. IVS will ascertain the number of shares outstanding and voting power of the shares, determine the shares represented at the meeting, whodetermine the validity of proxies and the ballots, count all votes and determine the results of voting. IVS will separately tabulate affirmativedeliver a written report after the meeting.

What happens if the Special Meeting is postponed or adjourned?

If the Special Meeting is postponed or adjourned for any reason, including to permit the further solicitation of proxies, at any subsequent reconvening of the Special Meeting all proxies will be voted in the same manner as above, you may revoke your proxy and

negative votes.change your vote at any time before the reconvened Special Meeting.

Granting aHow do I vote?

You may vote by mail. You do this by signing your proxy card and mailing it in the enclosed, prepaid and addressed envelope. If you mark your voting instructions on the Internetproxy card, your shares will be voted as you

instruct. If you return a signed proxy card but do not provide voting instructions, your shares will be voted “FOR” the proposal to amend the certificate of incorporation to effect a reverse stock split, ranging from a one-for-five reverse stock split to a one-for-thirty reverse stock split, of our common stock.

You may also vote in person at the Special Meeting. Written ballots will be passed out to anyone who wants to vote at the Special Meeting. If you hold your shares in “street name” (through a broker or other nominee), you must request a legal proxy from your stockbroker in order to vote at the Special Meeting.

You may also vote by the Internet. You may grant a proxy to vote your shares

of common stock, including shares of common stock issuable upon conversion of Series A preferred stock, by means of the Internet. The Internet voting procedures below are designed to authenticate your identity, to allow you to grant a proxy to vote your shares

of common stock, including shares of common stock issuable upon conversion of Series A preferred stock, and to confirm that your instructions have been recorded properly. If you grant a proxy to vote via the Internet, you should understand there may be costs associated with electronic access that you must bear, such as usage charges from Internet access providers and telephone companies.

The Company is incorporated under the laws of Delaware, and Section 212(c) of the Delaware General Corporation Law specifically permits electronically transmitted proxies, provided that each such proxy contains or is submitted with information from which the inspector of elections can determine that such proxy was authorized by the stockholder.

• | | For shares registered in your name |

For shares registered in your nameAs a stockholder of record, you may go tohttp://www.voteproxy.comwww.proxyvote.com to grant a proxy to vote your shares of common stock, including shares of common stock issuable upon conversion of Series A preferred stock, by means of the Internet. You will be required to provide our number andyour control number contained on your proxy card. You will then be asked to complete an electronic proxy card. The votes represented by such proxy will be generated on the computer screen, and you will be prompted to submit or revise them as desired.

• | | For shares registered in the name of a broker or bank |

For shares registered in the name of a broker or bankMost beneficial owners whose stock is held in street name receive instructions for granting proxies from their banks, brokers or other agents, rather than a proxy card. A number of brokers and banks are participating in a program provided through ADP Investor Communication Services that offers the means to grant proxies to vote shares by means of the telephone and Internet. If your shares are held in an account with a broker or bank participating in the ADP Investor Communication Services program, you may grant a proxy to vote those shares telephonically by calling the telephone number shown on the instruction form received from your broker or bank, or via the Internet at ADP Investor Communication Services'Services’ Web site athttp://www.bsg.adp.com.

• | | General information for all shares voted via the Internet |

We must receive votes submitted via the Internet by 11:59 p.m., Eastern Time, on December 16, 2002. Submitting your proxy via the Internet will not affect your right to vote in person should you decide to attend the Special Meeting.

Is my vote confidential?

Yes. Only the inspector of elections and certain other Internap employees will have access to your card. The inspector of elections will tabulate and certify the vote. All comments will remain confidential, unless you ask that your name be disclosed.

Where do I find the voting results of the Special Meeting?

We will announce preliminary voting results at the Special Meeting and will publish the final results in a current report on Form 8-K as soon as practicable after the Special Meeting. The report will be filed with the SEC, and you can get a copy by contacting our Investor Relations Department at (206) 441-8800, by contacting the SEC at (800) SEC-0330 for the location of the nearest public reference room, or through the SEC’s EDGAR system atwww.sec.gov.

Who will bear the cost of this proxy solicitation?

We will bear the entire cost of solicitation of proxies, including the costs of preparing, assembling, printing and mailing this proxy statement, the proxy card and any additional information furnished to stockholders. We will furnish copies of solicitation materials to banks, brokerage houses, fiduciaries and custodians holding in their names shares of our common stock and Series A preferred stock beneficially owned by others to forward to such beneficial owners. We may reimburse persons representing beneficial owners of common stock for forwarding solicitation materials to such beneficial owners. We have engaged W.F. Doring & Co., Inc., a professional proxy solicitation firm, to solicit proxies on our behalf and anticipate the cost of those services will be approximately $8,000. We may supplement the original solicitation of proxies by mail, telephone, telegram or personal solicitation by our directors, officers or other regular employees. We will not pay any additional compensation to our directors, officers or other regular employees for such services.

Proposal 1

APPROVALOF AMENDMENTSTO CERTIFICATE OF INCORPORATIONTO EFFECTA REVERSE STOCK SPLIT

The persons named in the enclosed proxy will vote to approve each of the separate six amendments to our certificate of incorporation effecting a reverse split of our common stock, unless the proxy is marked otherwise. If a stockholder returns a proxy without contrary instructions, the persons named as proxies will vote to approve each of the following amendments to our certificate of incorporation.

Our board of directors has unanimously adopted and declared advisable, each of the following amendments to the Fourth Article of our certificate of incorporation (each, a “Certificate of Amendment” and collectively, “Certificates of Amendment”). Although each of the Certificates of Amendment has been approved by the board of directors and we are seeking your approval for each such amendment set forth below, after receiving the requisite stockholder approval the board of directors may formally adopt not more than one of these amendments.

(a) Upon this Certificate of Amendment to our certificate of incorporation becoming effective pursuant to the General Corporation Law of the State of Delaware (the “Effective Time”), each share of common stock, par value $0.001 per share (the “Old Common Stock”), issued and outstanding immediately prior to the Effective Time, will be automatically reclassified as and converted into one fifth (1/5) of a share of our common stock, par value $0.001 per share (the “New Common Stock”). Any stock certificate that, immediately prior to the Effective Time, represented shares of the Old Common Stock will, from and after the Effective Time, automatically and without the necessity of surrendering the same for exchange, represent the number of whole shares of the New Common Stock as equals the product obtained by multiplying the number of shares of Old Common Stock represented by such certificate immediately prior to the Effective Time by one fifth (1/5), and the right to receive cash in lieu of a fraction of a share of New Common Stock; or

(b) Upon this Certificate of Amendment to our certificate of incorporation becoming effective pursuant to the General Corporation Law of the State of Delaware (the “Effective Time”), each share of our common stock, par value $0.001 per share (the “Old Common Stock”), issued and outstanding immediately prior to the Effective Time, will be automatically reclassified as and converted into one tenth (1/10) of a share of our common stock, par value $0.001 per share (the “New Common Stock”). Any stock certificate that, immediately prior to the Effective Time, represented shares of the Old Common Stock will, from and after the Effective Time, automatically and without the necessity of surrendering the same for exchange, represent the number of whole shares of the New Common Stock as equals the product obtained by multiplying the number of shares of Old Common Stock represented by such certificate immediately prior to the Effective Time by one tenth (1/10), and the right to receive cash in lieu of a fraction of a share of New Common Stock; or

(c) Upon this Certificate of Amendment to our certificate of incorporation becoming effective pursuant to the General Corporation Law of the State of Delaware (the “Effective Time”), each share of our common stock, par value $0.001 per share (the “Old Common Stock”), issued and outstanding immediately prior to the Effective Time, will be automatically reclassified as and converted into one fifteenth (1/15) of a share of our common stock, par value $0.001 per share (the “New Common Stock”). Any stock certificate that, immediately prior to the Effective Time, represented shares of the Old Common Stock will, from and after the Effective Time, automatically and without the necessity of surrendering the same for exchange, represent the number of whole shares of the New Common Stock as equals the product obtained by multiplying the number of shares of Old Common Stock represented by such certificate immediately prior to the Effective Time by one fifteenth (1/15), and the right to receive cash in lieu of a fraction of a share of New Common Stock; or

(d) Upon this Certificate of Amendment to our certificate of incorporation becoming effective pursuant to the General Corporation Law of the State of Delaware (the “Effective Time”), each share of our common stock,

par value $0.001 per share (the “Old Common Stock”), issued and outstanding immediately prior to the Effective Time, will be automatically reclassified as and converted into one twentieth (1/20) of a share of our common stock, par value $0.001 per share (the “New Common Stock”). Any stock certificate that, immediately prior to the Effective Time, represented shares of the Old Common Stock will, from and after the Effective Time, automatically and without the necessity of surrendering the same for exchange, represent the number of whole shares of the New Common Stock as equals the product obtained by multiplying the number of shares of Old Common Stock represented by such certificate immediately prior to the Effective Time by one twentieth (1/20) and the right to receive cash in lieu of a fraction of a share of New Common Stock; or

(e) Upon this Certificate of Amendment to our certificate of incorporation becoming effective pursuant to the General Corporation Law of the State of Delaware (the “Effective Time”), each share of our common stock, par value $0.001 per share (the “Old Common Stock”), issued and outstanding immediately prior to the Effective Time, will be automatically reclassified as and converted into one twenty-fifth (1/25) of a share of our common stock, par value $0.001 per share (the “New Common Stock”). Any stock certificate that, immediately prior to the Effective Time, represented shares of the Old Common Stock will, from and after the Effective Time, automatically and without the necessity of surrendering the same for exchange, represent the number of whole shares of the New Common Stock as equals the product obtained by multiplying the number of shares of Old Common Stock represented by such certificate immediately prior to the Effective Time by one twenty-fifth (1/25) and the right to receive cash in lieu of a fraction of a share of New Common Stock; or

(f) Upon this Certificate of Amendment to our certificate of incorporation becoming effective pursuant to the General Corporation Law of the State of Delaware (the “Effective Time”), each share of our common stock, par value $0.001 per share (the “Old Common Stock”), issued and outstanding immediately prior to the Effective Time, will be automatically reclassified as and converted into one thirtieth (1/30) of a share of our common stock, par value $0.001 per share (the “New Common Stock”). Any stock certificate that, immediately prior to the Effective Time, represented shares of the Old Common Stock will, from and after the Effective Time, automatically and without the necessity of surrendering the same for exchange, represent the number of whole shares of the New Common Stock as equals the product obtained by multiplying the number of shares of Old Common Stock represented by such certificate immediately prior to the Effective Time by one thirtieth (1/30) and the right to receive cash in lieu of a fraction of a share of New Common Stock.

Approval of each of the Certificates of Amendment requires the affirmative vote of holders of a majority of our outstanding capital stock entitled to vote on each of the amendments. The affirmative vote of the holders of a majority of our outstanding capital stock (consisting of shares of our common stock and the shares of common stock issuable upon conversion of Series A preferred stock) entitled to vote on each of the amendments is required for each of the Certificates of Amendment.

Purpose of Reverse Stock Split Each of the proposed Certificates of Amendment, effectuating a reverse stock split, ranging from between a one-for-five reverse stock split and a one-for-thirty reverse stock split, has been approved and declared advisable by the board of directors to reduce the number of issued and outstanding shares of our common stock in order to increase the trading price of such shares on The Nasdaq SmallCap Market. The board of directors took this action because our common stock has not met, for more than 30 consecutive trading days since March 12, 2002, the $1.00 minimum bid price required by Nasdaq Marketplace Rule 4450, or the “Rule,” and we have since transferred our listing from The Nasdaq National Market to The Nasdaq SmallCap Market. With the exception of the $1.00 minimum bid price requirement, we currently are in compliance with the continued listing requirements on The Nasdaq SmallCap Market, which we refer to as the SmallCap Market Continued Listing Requirements, including the $2.5 million stockholders’ equity requirement and the requirement that our “publicly held” shares have a market value of at least $1 million, although we may be unable to continue to meet these or other Nasdaq SmallCap Market requirements in the future. For purposes of the Nasdaq rules, the term “publicly held” only includes shares listed on a national securities exchange or inter-dealer quotation system and excludes all shares held by our directors, officers, 10% stockholders and their respective affiliates. Therefore, none of our

shares of common stock held by “insiders” and their affiliates, and none of our shares of Series A preferred stock (unless converted into shares of common stock), will count toward the “publicly held” requirement.

Although there can be no assurance, the board of directors believes the implementation of one of the proposed amendments effectuating a reverse stock split, if approved by our stockholders, will result in an increase in the minimum bid price of our common stock to above the $1.00 per share minimum for a period of at least 10 consecutive trading days mandated by The Nasdaq SmallCap Market for continued listing on The Nasdaq SmallCap Market, and for the 30 consecutive trading day period required to enable our common stock to be eligible to be transferred back to The Nasdaq National Market. However, although we believe that implementation of a reverse stock split is a satisfactory mechanism to achieve compliance with The Nasdaq SmallCap Market’s maintenance requirements, there can be no assurance that, even if the bid price for our common stock exceeds the $1.00 minimum threshold for the mandated period as a result of a reverse stock split, The Nasdaq SmallCap Market will deem us to be in compliance with the Rule and will not de-list our common stock. In addition, we cannot assure you that (1) even if we satisfied Nasdaq’s minimum bid price maintenance standard, we would be able to meet Nasdaq’s other continued listing criteria or (2) our common stock would not be de-listed by Nasdaq for other reasons.

On April 24, 2002, we were initially notified of our failure to comply with the Rule. Nasdaq granted us 90 calendar days, or until July 23, 2002, to regain compliance with the Rule. Subsequently, we were unable to demonstrate compliance with the Rule on or before July 23, 2002, and we received a formal notice of de-listing from The Nasdaq National Market on July 24, 2002. This automatic de-listing was temporarily stayed during our appeal of the de-listing before the Nasdaq Listing Qualifications Panel, or the “Panel.” At our hearing with the Panel, which occurred on August 29, 2002, we petitioned to maintain our listing on The Nasdaq National Market pending stockholder approval and implementation of one of the proposed amendments effectuating a reverse stock split of our common stock.

On October 2, 2002, the Panel denied our petition for continued inclusion on The Nasdaq National Market, and determined to transfer our common stock listing to The Nasdaq SmallCap Market, effective October 4, 2002. Subsequently, on October 21, 2002, the Panel granted us an additional 180-day grace period, until April 21, 2003, to satisfy the $1.00 bid requirement. The Panel also stated that our listing on The Nasdaq SmallCap Market was pursuant to the terms of the following exception:

| 1. | | We must receive votes submitted viaprovide documentation to the Internet by 2:00 p.m., Eastern Daylight Time,Panel on May 13, 2002. Submitting your proxy viaor before November 14, 2002 evidencing that the Internetterms of at least $45 million of our outstanding Series A preferred stock have been modified such that the Series A preferred stock will not affect your right to vote in person should you decide to attendbe classified as equity under U.S. GAAP. Further, we must file a quarterly report on Form 10-Q on or before November 14, 2002 for the annual meeting.Revocabilityquarter ended September 30, 2002 evidencing stockholders’ equity of proxies

If you grantat least $12 million. This quarterly report must also include a proxy pursuant to this solicitation you may revoke itsecond balance sheet with pro forma adjustments for any significant events or transactions occurring on or before the filing date, evidencing stockholders’ equity of at any time before it is voted. You may revoke your proxy by filing withleast $52 million. As of September 30, 2002, we had approximately $14.8 million of stockholders’ equity on our Secretary, at our principal executive office (Two Union Square, 601 Union Street, Suite 1000, Seattle, Washington 98101), a written notice of revocation or a duly executed proxy bearing a later date. You may also revoke your proxy by attending the meeting and voting in person; however, attendance at the meetingbalance sheet, which we will not, by itself, revoke your proxy.

Stockholder proposals

The deadline for submitting a stockholder proposal for inclusionreport in our proxy statement and form of proxyForm 10-Q for the 2003 annual meetingperiod ended September 30, 2002. In addition, as of stockholders, pursuant to Rule 14a-8that date, our balance sheet reflected approximately $80.3 million of Series A preferred stock, classified as mezzanine under U.S. GAAP rather than as a component of stockholders’ equity. On October 3, 2002, having received the consent of the Securities and Exchange Commission ("SEC"), is .

Stockholders who intend to presentholders of a proposal at the 2003 annual meeting without inclusionrequisite number of such proposal in the proxy materials are required to provide notice to us no later than , assuming the 2003 annual meeting is held within 30 days of the anniversary date of the 2002 annual meeting. You are also advised to review our bylaws, which contain additional requirements about advance notice of stockholder proposals.

PROPOSAL 1

AMEND OUR CERTIFICATE OF INCORPORATION AND BYLAWS

Our board of directors has approved and recommends that the stockholders approve an amendment to our certificate of incorporation (the "Certificate Amendment") and a related amendment to our bylaws (the "Bylaws Amendment") pursuant to which the holdersshares of our Series A preferred stock, would be permittedwe amended the Series A preferred stock designation. This amendment will allow us to take action by written consent.

Introduction

On November 29, 2001, our board of directors adopted, subject to appropriate stockholder approval,present the Certificate Amendment and the Bylaws Amendment (collectively, the "Amendments") as set forth inAPPENDIX A hereto, and in a special meeting held on February 21, 2002, holdersentire $80.3 million of Series A preferred stock voting as a single class, approvedcomponent of stockholders’ equity in future periods. Therefore, we expect to be able to comply with the Amendments. In general, the Amendments provide that the holders of our Series A preferred stock may take action by written consent. We believe that the proposed Amendments will provide greater flexibility and greater efficiency when soliciting required approvals from holders of our Series A preferred stock.

Summary descriptionterms of the amendmentsPanel’s requirement relating to our stockholders’ equity by November 14, 2002. We also expect to be able to provide the pro forma balance sheet required by Nasdaq with our quarterly report on Form 10-Q filed on or before November 14, 2002.

|

As an alternative, if we are in compliance with the $35 million market value of listed securities standard for a minimum of ten consecutive trading days prior to November 14, 2002, we must notify the Panel, which will then render a determination with respect to our listing.

| 2. | | The following isOn or before April 21, 2003, we must demonstrate a summaryclosing bid price of the Amendments. The complete textat least $1.00 per share and immediately thereafter, we must evidence a closing bid price of the Amendments (as well as the textat least $1.00 per share for aminimum of the provisions the Amendments are replacing) is attached asten consecutive trading days.APPENDIX A hereto.Certificate Amendment

Article V, Section D of our current certificate of incorporation provides that no action shall be taken by our stockholders (which include both holders

|

If we fail to comply with any of the foregoing conditions, Nasdaq has notified us that our listing will be terminated immediately. Further, the Panel’s written decision stated that the Panel expressly reserves the right to modify, alter or extend the terms of the foregoing conditions upon a review of our reported financial results for the quarter ended September 30, 2002, which we announced on October 29, 2002.

If the proposed amendments effectuating a reverse stock split are approved by the stockholders, our board of directors may implement one of the proposed amendments effectuating a reverse stock split of our common stock while we are listed on The Nasdaq SmallCap Market. If, after the implementation of one of the proposed amendments effectuating a reverse stock split, we have been in compliance with the Rule for 10 consecutive trading days and the conditions specified in the Panel’s letter discussed above, and we otherwise comply with the SmallCap Market Continued Listing Requirements, we expect to be eligible to remain on The Nasdaq SmallCap Market. If, after the implementation of one of the proposed amendments effectuating a reverse stock split, we do not comply with the Rule for 10 consecutive trading days and the conditions specified in the Panel’s letter discussed above, we may be de-listed from The Nasdaq SmallCap Market.

Nasdaq has informed us that we may be eligible to transfer back to The Nasdaq National Market, without paying the initial listing fees, if, on or prior to April 21, 2003, we have been in compliance with the Rule for 30 consecutive trading days and we otherwise comply with the National Market Continued Listing Requirements. On the other hand, if, on or before April 21, 2003, the closing price of our common stock has not met or exceeded $1.00 for at least 10 consecutive trading days, we would be subject to de-listing from The Nasdaq SmallCap Market. In addition, we will need to maintain compliance with all continued listing requirements of The Nasdaq SmallCap Market (other than the $1.00 minimum bid price requirement), in addition to the conditions specified by the Panel in its letter, in order to continue our grace period on The Nasdaq SmallCap Market. These continued listing requirements require, among other things, that we maintain a minimum stockholders’ equity of $2.5 million. We cannot assure you that we will maintain compliance with these or any other of the continued listing requirements, including the conditions specified in the Panel’s decision on October 2, 2002 discussed above. If we fall out of compliance with the Panel’s conditions or any of the other continued listing requirements of The Nasdaq SmallCap Market, we may be subject to immediate de-listing. We would expect to be able to appeal any de-listing from The Nasdaq SmallCap Market.

If our common stock is de-listed from The Nasdaq SmallCap Market, trading in our common stock, if any, would need to be conducted on the OTC Bulletin Board or in the non-Nasdaq over-the-counter market (also known as the “pink sheet market”). In such event, an investor could find it more difficult to dispose of or to obtain accurate quotations as to the market value of our common stock.

Further, even if our common stock continues to be traded on The Nasdaq SmallCap Market and the trading price were to remain below $5.00 per share, trading in our common stock would remain subject to the requirements of certain rules promulgated under the Exchange Act, which require additional disclosures by broker-dealers in connection with any trades involving a stock defined as a “penny stock.” Generally, a “penny stock” is defined as any equity security that (i) is not traded on any nationally recognized stock exchange or inter-dealer quotation system and (ii) has a market price of less than $5.00 per share, subject to certain exceptions. The additional burdens imposed upon broker-dealers by these requirements could discourage broker-dealers from facilitating trades in our common stock, which could severely limit the market liquidity of the stock and the ability of investors to trade our common stock.

The board of directors is asking that you approve each of the proposed amendments to our certificate of incorporation effectuating each of the reverse stock splits of all of our issued and outstanding common stock. Notwithstanding the authorization of each of the amendments by the stockholders, the board of directors may

abandon any of the amendments without further action by our stockholders in accordance with Section 242(c) of the General Corporation Law of the State of Delaware. A vote in favor of each of the amendments to our certificate of incorporation will be a vote for approval of each of the proposed reverse stock splits, one of which may be implemented and effectuated and any of which may be abandoned at the discretion of the board of directors at any time until the nine month anniversary of the Special Meeting, and for granting authority to the board of directors to effectuate the reverse stock split.

The board of directors has determined that each of the amendments effectuating a reverse stock split is advisable and in your best interests and unanimously recommends that you vote “FOR” each of the amendments effectuating a reverse stock split. The board of directors will consider and evaluate from time to time the following factors and criteria to determine which, if any, of the approved amendments to implement: our capitalization (including the number of shares of our common stock issued and outstanding and the number of shares issuable upon conversion of Series A preferred stock), the prevailing trading price for our common stock and the volume level thereof, potential devaluation of our market capitalization as a result of a reverse stock split, and the general economic and other related conditions prevailing in our industry and in the marketplace generally. The board of directors will determine, at such time as it deems desirable, which proposed amendment to implement and will provide stockholders and other relevant persons with notice of the record date for the proposed reverse stock split. The board of directors has no immediate plans to implement a reverse stock split, even if we obtain stockholder approval for the proposed amendments.

Effects of Reverse Stock Split A reverse stock split is a reduction in the number of outstanding shares of a class of a corporation’s capital stock, which may be accomplished by the company, in this case, by reclassifying and converting all our outstanding shares of common stock into a proportionately fewer number of shares of common stock. For example, if our board of directors implements a one-for-ten reverse stock split of our common stock, then a stockholder holding 1000 shares of our common stock before the reverse stock split would receive 100 shares of our common stock after the reverse stock split. This action will also result in a relative increase in the available number of authorized but unissued shares of our common stock. Each stockholder’s proportionate ownership of the issued and outstanding shares of our common stock would remain the same, however, except for minor changes which may result from the provisions of each of the amendments effectuating a reverse stock split, as described below. As described below, any fractional shares resulting from a reverse stock split will be rounded down to the nearest whole share and stockholders holding fractional shares of our common stock may be entitled to cash payments in lieu of such fractional shares of our common stock. Common stock issued pursuant to the reverse stock split will remain fully paid and non-assessable.

The primary purpose of the proposed reverse stock split of our common stock is to combine the issued and outstanding shares of our common stock into a smaller number of shares of our common stock so that the shares of our common stock will trade at a higher price per share than their recent trading prices. Although we expect the reverse split will result in an increase in the market price of our common stock, the reverse split may not increase the market price of our common stock in proportion to the reduction in the number of shares of our common stock outstanding or result in the permanent increase in the market price, which is dependent upon many factors, including our performance, prospects and other factors. The history of similar reverse stock splits for companies in like circumstances is varied. In addition to increasing the market price of our common stock, a reverse stock split will also affect the presentation of stockholders’ equity on our balance sheet. Because the par value of the shares of our common stock is not changing as a result of the implementation of the reverse stock split, our stated capital, which consists of the par value per share of our common stock multiplied by the aggregate number of shares of our common stock issued and outstanding, will be reduced proportionately on the effective date of the reverse stock split. Correspondingly, our additional paid-in capital, which consists of the difference between our stated capital and the aggregate amount paid to us upon the issuance of all currently outstanding shares of our common stock, will be increased by a number equal to the decrease in stated capital.

The market price of our common stock will also be based on our performance and other factors, many of which are unrelated to the number of shares of our common stock outstanding. If the reverse stock split is effected and the market price of our common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of a reverse stock split.

Finally, the reverse stock split, if implemented, will affect the outstanding options and warrants to purchase our common stock and certain other presently outstanding convertible securities with respect to our common stock (including the shares of our common stock issuable upon conversion of Series A preferred stock), which contain anti-dilution provisions. All of our option plans with respect to common stock include provisions requiring adjustments to the number of shares of our common stock covered thereby and the number of shares of our common stock subject to and the exercise prices of outstanding options granted under said plans, in the event of a reverse stock split. For example, in a one-for-ten reverse stock split, each of the outstanding options to purchase common stock would thereafter evidence the right to purchase that number of shares of our common stock following the reverse stock split equal to one-tenth of the number of shares of our common stock previously covered by the options (fractional shares will be rounded down and any fractions of a share may be exchanged for a cash payment in some cases, as described in the section “No Fractional Shares”) and the exercise price per share would be ten times the previous exercise price. Further, the number of shares of our common stock reserved for issuance (including the number of shares subject to automatic annual increase and the maximum number of shares that may be subject to options) under our existing stock option plans and employee stock purchase plans will be reduced one-fifth, one-tenth, one-fifteenth, one-twentieth, one-twenty-fifth or one-thirtieth, of the number of shares currently included in such plans. Similarly, in the case of a one-for-ten reverse stock split, pursuant to Section IV(D)(4)(c), each share of our Series A preferred stock would thereafter be convertible at a conversion price of $14.8256 (equal to ten times our current conversion price of $1.48256) and, correspondingly, each share of Series A preferred stock would be convertible into 2.16 shares of common stock (or a cash payment for any fractions of a share) (equal to one-tenth of the number of shares of common stock into which each share of our Series A preferred stock is currently convertible).

The following table illustrates the effects of a 1-for-5 and a 1-for-30 reverse stock split, without giving effect to any adjustments for fractional shares of our common stock, on our authorized and outstanding shares of our capital stock and on certain per share data:

| | | Number of Shares as of September 30, 2002

| |

| | | Prior to Reverse Stock Split

| | | After Reverse Split

| |

| | | | 1 for 5

| | | 1 for 30

| |

| Authorized | | | | | | | | | | | | |

| Series A preferred stock | | | 200,000,000 | | | | 200,000,000 | | | | 200,000,000 | |

| Common Stock | | | 600,000,000 | | | | 600,000,000 | | | | 600,000,000 | |

| Series A preferred stock | | | | | | | | | | | | |

| Outstanding | | | 2,950,243 | | | | 2,950,243 | | | | 2,950,243 | |

| Shares of Common Stock issuable upon conversion of Series A preferred stock | | | 63,678,871 | | | | 12,735,774 | | | | 2,122,629 | |

| Common Stock | | | | | | | | | | | | |

| Outstanding | | | 159,340,993 | | | | 31,868,198 | | | | 5,311,366 | |

| Issuable upon exercise of Options and Warrants | | | 38,583,777 | | | | 7,716,755 | | | | 1,286,125 | |

| Stockholder equity at December 31, 2001 | | $ | 66,169,000 | | | $ | 66,169,000 | | | $ | 66,169,000 | |

| Stockholder equity per share at December 31, 2001 | | $ | 0.44 | | | $ | 2.19 | | | $ | 13.12 | |

| Net loss for year ended December 31, 2001 | | $ | (479,162 | ) | | $ | (479,162 | ) | | $ | (479,162 | ) |

| Basic and diluted net loss per share for year ended December 31, 2001 | | $ | (3.19 | ) | | $ | (15.95 | ) | | $ | (95.70 | ) |

No fractional shares of common stock will be issued in connection with a reverse stock split. If as a result of a reverse stock split, a stockholder of record would hold a fractional share, the stockholder, in lieu of the issuance of a fractional share, may be entitled to receive a payment in cash. The terms of some of our stock option plans do not require us to, and we therefore would not expect to, pay cash to optionholders in lieu of any fraction of a share issuable upon the exercise of an option. The board of directors may elect either (i) to arrange for our transfer agent to aggregate and sell these fractional shares of our common stock on the open market or (ii) to make a cash payment in an amount per share equal to the average of the closing prices per share on The Nasdaq SmallCap Market for the period of ten consecutive trading days ending on (and including) the effective date of a reverse stock split, without interest. The ownership of a fractional interest will not give the holder thereof any voting, dividend or other right except to receive the cash payment therefor. We estimate that the total payments to stockholders to cash out fractional shares of common stock will be between $12,000 and $20,000, depending on, among other things, which of the proposed amendments is effected by the board of directors.

Stockholders should be aware that, under the escheat laws of the various jurisdictions where stockholders reside, where we are domiciled and where the funds will be deposited, sums due for fractional interests that are not timely claimed after the effective time may be required to be paid to the designated agent for each such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds may have to seek to obtain them directly from the state to which they were paid.

Implementation of Reverse Stock Split If the stockholders approve the amendments effectuating a reverse stock split, the board of directors may, at any time until the nine month anniversary of the Special Meeting, direct our management to file an amendment to our certificate of incorporation incorporating one of the amendments to our certificate of incorporation with the Secretary of State of the State of Delaware effecting one of the reverse stock splits. Our board of directors reserves the right, in its sole discretion, not to make such filing and not to complete the reverse stock split if it deems it appropriate not to do so. Those Certificates of Amendment not filed with the Secretary of State of the State of Delaware shall be deemed null and void.

Reasons For Reverse Stock Split The board of directors believes that a reverse stock split is desirable for the following reasons:

| (a) | | If shares of our common stock and holders of our Series A preferred stock) except at an annual meeting or special meeting. The Certificate Amendment would revise Article V, Section D to permit the holders of our Series A preferred stock to take any action that may be taken or that is required by statute to be taken at any annual or special meeting, without a meeting, without prior notice and without a vote, so long as such action is taken in accordance with the bylaws. The proposed Certificate Amendment would, however, continue to require that any actiontrade below $1.00 per share, our common stock will be de-listed from The Nasdaq SmallCap Market and we will not be eligible to be taken by holderstransfer our listing back to The Nasdaq National Market. De-listing could decrease the marketability, liquidity and transparency of our common stock be taken only at an annual or special meeting.Bylaws Amendment

Section 13(which could, in turn, further depress our stock price). The board of our current bylaws providesdirectors believes that no action shall be taken by our stockholders (which includes both holdersthe anticipated increase in the market price per share resulting from a reverse stock split will lift the price of our common stock and holders ofabove the $1.00 minimum bid threshold that currently threatens our Series A preferred stock) except at an annual or special meeting and specifically states that no action shall be taken by our stockholders by written consent.continued listing on The Bylaws Amendment would revise Section 13 to permitNasdaq SmallCap Market.

|

| (b) | | The anticipated increase in the holders of our Series A preferred stock to take any action that may be taken or that is required by statute to be taken at any3

annual or special meeting by written consent. The proposed Bylaws Amendment would, however, continue to require that any action to be taken by holdersper share market price of our common stock be taken at an annual or special meeting and wouldshould also continue to specifically prohibit holdersenhance the acceptability of our common stock by the financial community and the investing public.

|

| (c) | | A variety of brokerage house policies and practices tend to discourage individual brokers within those firms from taking action by written consent. Holdersdealing with lower priced stocks. Some of the policies and practices pertain to the payment of broker’s commissions and to time consuming procedures that function to make the handling of lower priced stock economically unattractive to brokers and therefore difficult for holders of common stock to manage. The expected increase in the per share price of our common stock are requestedmay help alleviate some of these issues.

|

| (d) | | The structure of trading commissions also tends to approve the Amendments. In a special meeting held on February 21, 2002,have an adverse impact upon holders of Serieslower priced stock because the brokerage commission on a sale of lower priced stock generally represents a |

| higher percentage of the sales prices than the commission on a relatively higher priced issue, which may discourage trading in lower priced stock. A preferredreverse stock voting assplit could result in a single class,price level for our common stock that may reduce, to some extent, the effect of these policies and practices of brokerage firms and diminish the adverse impact of trading commissions on the market for our common stock. |

| (e) | | The increase in the portion of our authorized shares of common stock that would be unissued after the reverse stock split is effectuated could be used for any proper corporate purpose approved by the Amendments. Also,board of directors. The increased number of authorized but unissued shares of our common stock will provide us with additional flexibility to issue additional shares of our common stock in connection with future financings or other transactions. However, the board of directors has considereddoes not currently have any plans to utilize the Amendmentsincrease in the number of the authorized but unissued shares of our common stock that would result from approval and has unanimously concluded that the potential benefitsimplementation of the proposed changesreverse stock split. |

Reasons Against Reverse Stock Split Even though the board of directors believes that the potential advantages of a reverse stock split outweigh any disadvantages that might result, the following are the possible disadvantages of a reverse stock split:

| (a) | | Despite the potential increase in liquidity discussed above, if we file one of the amendments, the reduced number of shares of our common stock resulting from a reverse stock split could adversely affect the liquidity of our common stock. |

| (b) | | A reverse stock split could result in a significant devaluation of our market capitalization and our share price, on an actual or an as-adjusted basis, based on the experience of other companies that have effected reverse stock splits in an effort to maintain their Nasdaq listings. |

| (c) | | A reverse stock split may leave certain stockholders with one or more “odd lots,” which are stock holdings in amounts of less than 100 shares of our common stock. These odd lots may be more difficult to sell than shares of our common stock in even multiples of 100. Additionally, any potential disadvantages. Ourreduction in brokerage commissions resulting from the reverse stock split, as discussed above, may be offset, in whole or in part, by increased brokerage commissions required to be paid by stockholders selling odd lots created by the reverse stock split. Similarly, a reverse stock split could reduce our number of “round lot” stockholders, which are holders of 100 or more shares of our common stock. The continued inclusion requirements of The Nasdaq National Market and The Nasdaq SmallCap Market require us to maintain a specified minimum number of round lot stockholders. |

| (d) | | Because a reverse stock split would result in an increased number of authorized but unissued shares of our common stock, it may be construed as having an anti-takeover effect, although neither the board of directors believesnor our management views this proposal in that perspective. However, the Amendments are in our best interests and that of our stockholders and recommends a vote in favor of the Amendments.THE BOARD RECOMMENDS A VOTE IN FAVOR

OF AMENDING THE COMPANY'S CERTIFICATE OF

INCORPORATION AND BYLAWS AS DISCUSSED IN THIS PROPOSAL

PROPOSAL 2

ELECTION OF DIRECTORS

Our certificate of incorporation and bylaws provide that our board of directors, shall be divided into three classes, each class consisting, as nearly as possible, of one-third of the totalsubject to its fiduciary duties and applicable law, could use this increased number of authorized but unissued shares of our common stock to frustrate persons seeking to take over or otherwise gain control of us by, for example, privately placing shares of our common stock with purchasers who might side with the board of directors which accordingin opposing a hostile takeover bid. Shares of our common stock could also be issued to a holder that would thereafter have sufficient voting power to assure that any proposal to amend or repeal our by-laws or certain provisions of our certificate of incorporation may be upwould not receive the requisite vote. Such uses of our common stock could render more difficult, or discourage, an attempt to seven directors, with each class having a three-year term. Vacancies onacquire control of us if such transaction were opposed by the board of directors maydirectors.

|

| (e) | | Further, subject to Nasdaq rules on stock issuances, the increased number of authorized but unissued shares of our common stock could be filled by persons elected by a majority of the remaining directors. A director electedissued by the board of directors to fill a vacancy (including a vacancy created by an increasewithout further stockholder approval, which could result in the number of directors) shall serve for the remainder of the full term of the class of directors in which the vacancy occurred and until such director's successor is elected and qualified. Our board of directors is presently composed of six members with one vacancy in Class I. There are three directors currently in the class whose terms of office expire in 2002, which is designated as Class III. These directors will stand as nominees for election to Class III at the annual meeting. The nominees for election to Class III are current directors who were previously elected by the stockholders. If elected at the annual meeting, each nominee would serve until the 2005 annual meeting and until his successor is elected and has been qualified, or until such director's earlier death, resignation or removal.

Directors are elected by a plurality of the votes cast that are present in person or represented by proxy and entitled to vote at the meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, FOR the election of the nominees named below. Should these nominees be unavailable for election as a result of an unexpected occurrence, these shares will be voted for the election of substitute nominees proposed by management. The persons nominated for election to Class III have agreed to serve if elected, and management has no reason to believe they will be unable to serve.

Nominees for election for a three-year term expiring at the 2005 annual meeting

Eugene Eidenberg (age 62) has served as a director and chairman of the board of directors since November 1997. Effective in July 2001, Mr. Eidenberg began serving as Internap's Chief Executive Officer. Mr. Eidenberg has been a Managing Director of Granite Venture Associates LLC since 1999 and has served as a Principal of Hambrecht & Quist Venture Associates since 1998 and was an advisory director at the San Francisco investment banking firm of Hambrecht & Quist from 1995 to 1998. Mr. Eidenberg served for 12 years in a number of senior management positions with MCI Communications Corporation. His positions at MCI included Senior Vice President for Regulatory and

4

Public Policy, President of MCI's Pacific Division, Executive Vice President for Strategic Planning and Corporate Development and Executive Vice President for MCI's international businesses. Mr. Eidenberg is currently a director of several private companies. Mr. Eidenberg holds a Ph.D. and a Master of Arts degree from Northwestern University and a Bachelor of Arts degree from the University of Wisconsin.

William J. Harding (age 54) has served as a director since January 1999. Dr. Harding is a Managing Member of Morgan Stanley Venture Partners and Managing Director of Morgan Stanley & Co., Inc. He joined Morgan Stanley & Co., Inc. in October 1994. Dr. Harding is currently a Director of Commerce One, Inc. and several private companies. Prior to joining Morgan Stanley, Dr. Harding was a General Partner of several venture capital partnerships affiliated with J.H. Whitney & Co. Previously, Dr. Harding was associated with Amdahl Corporation from 1976 to 1985, serving in various technical and business development roles. Prior to Amdahl, Dr. Harding held several technical positions with Honeywell Information Systems. Dr. Harding holds a Bachelor of Science in Engineering Mathematics and a Master of Science in Systems Engineering from the University of Arizona, and a Ph.D. in Engineering from Arizona State University. Dr. Harding served as an officer in the Military Intelligence Branch of the United States Army Reserve.

Anthony C. Naughtin (age 46) co-founded Internap and served as our Chief Executive Officer from May 1996 until July 2001 and served as our President from May 1996 until May 2001. Mr. Naughtin has also served as a director since October 1997. Prior to founding Internap, he was vice president for commercial network services at ConnectSoft, Inc., an Internet and e-mail software developer, from May 1995 to May 1996. From February 1992 to May 1995, Mr. Naughtin was the director of sales at NorthWestNet, an NSFNET regional network. Mr. Naughtin has served as a director of Counterpane Internet Security, Inc. since March 2001 and also participates on the advisory boards of Terabeam Corporation, ThruPoint, Inc., 360Networks, Inc. and the University of Washington School of Business. Mr. Naughtin holds a Bachelor of Arts in Communications from the University of Iowa and is a graduate of the Creighton School of Law.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF THE NAMED NOMINEES.

Director continuing in office until the 2003 annual meeting

Robert D. Shurtleff, Jr. (age 47) has served as a director since January 1997. In 1999, Mr. Shurtleff founded S.L. Partners, a strategic consulting group focused on early stage companies. From 1988 to 1998, Mr. Shurtleff held various positions at Microsoft Corporation, including Program Management and Development Manager and General Manager. Mr. Shurtleff is currently a director of four private companies and also serves on technical advisory boards of several private companies and venture capital firms. Prior to working at Microsoft Corporation, Mr. Shurtleff worked at Hewlett Packard Company from 1979 to 1988. Mr. Shurtleff holds a Bachelor of Arts degree in computer science from the University of California at Berkeley.

Directors continuing in office until the 2004 annual meeting

Fredric W. Harman (age 41) has served as a director since January 1999. Since 1994, Mr. Harman has served as a Managing Member of the General Partners of venture capital funds affiliated with Oak Investment Partners. Mr. Harman served as a General Partner of Morgan Stanley Venture Capital, L.P. from 1991 to 1994. Mr. Harman serves as a director of Avenue A, Inktomi Corporation, Primus Knowledge Solutions and several privately held companies. Mr. Harman holds a Bachelor of Science degree and a Master degree in electrical engineering from Stanford University and a Master of Business Administration from Harvard University.

5

Kevin L. Ober (age 40) has served as a director since October 1997. From February 2000dilution to the present Mr. Ober has been involved in various business activities including sitting on the boards of several start-up companies including PictureIQ and HealthRadius. From November 1993 to January 2000 Mr. Ober was a member of the investment team at Vulcan Ventures Inc. Prior to working at Vulcan Ventures, Mr. Ober served in various positions at Conner Peripherals, Inc., a computer hard disk drive manufacturer. Mr. Ober holds a Master of Business Administration from Santa Clara University and Bachelor of Science degree in business administration from St. John's University.

Board of directors committees and meetings

During the fiscal year ended December 31, 2001, the board of directors held 21 meetings and acted by unanimous written consent eight times. The board of directors has an audit committee and a compensation committee.

The audit committee meets with our independent accountants at least annually to review the results of the annual audit and discuss the financial statements, recommends to the board of directors the independent accountants to be retained, oversees the independence of the independent accountants, evaluates the independent accountants' performance and receives and considers the independent accountants' comments as to controls, adequacy of staff and management performance and procedures in connection with audit and financial controls. The audit committee is composed of three directors, William J. Harding, Fredric W. Harman and Kevin L. Ober all of whom are independent as independence is defined in NASD Rule 4200(a)(14). It meets at least quarterly to discuss quarterly financial results prior to their public release. The audit committee held five meetings during the fiscal year. The audit committee has adopted a written audit committee charter which was filed as an attachment to our 2001 proxy statement. A report of the audit committee is included later in this proxy statement.

The compensation committee reviews and recommends to the board of directors the compensation and benefits of all our officers and establishes and reviews general policies relating to compensation and benefits for our employees. The compensation committee consists of two nonemployee directors, Kevin L. Ober and Robert D. Shurtleff, Jr. The compensation committee held three meetings during the fiscal year and acted by unanimous written consent 75 times. A report of the compensation committee is included later in this proxy statement.